Top 4 τρόποι για να κάνετε τα χρήματά σας να δουλεύουν για εσάς

Τα χρήματα είναι ένα ισχυρό εργαλείο που μπορεί να προσφέρει άνεση και σταθερότητα στην οικογένειά σας, να σας βοηθήσει να σχεδιάσετε το μέλλον και να διευκολύνει την αποταμίευση για σημαντικά ορόσημα. Ωστόσο, για να πετύχετε αυτά τα πράγματα, είναι σημαντικό να κατακτήσετε την τέχνη να κάνετε τα χρήματά σας να δουλεύουν για εσάς, πράγμα που σημαίνει να παίρνετε τον έλεγχο των οικονομικών σας και να χρησιμοποιείτε αυτόν τον έλεγχο για να βελτιώνετε συνεχώς την οικονομική σας σταθερότητα και ασφάλεια. Ας ρίξουμε μια ματιά σε 4 πρακτικά βήματα που μπορείτε να κάνετε αμέσως για να κάνετε τα χρήματά σας να δουλεύουν για εσάς.

Το χρήμα είναι ένα ισχυρό εργαλείο που μπορεί να προσφέρει άνεση και σταθερότητα στην οικογένειά σας, να σας βοηθήσει να προγραμματίσετε το μέλλον και να διευκολύνει την αποταμίευση για σημαντικά ορόσημα. Ωστόσο, για να πετύχετε αυτά τα πράγματα, είναι σημαντικό να κατακτήσετε την τέχνη να κάνετε τα χρήματά σας να δουλεύουν για εσάς, πράγμα που σημαίνει να παίρνετε τον έλεγχο των οικονομικών σας και να χρησιμοποιείτε αυτόν τον έλεγχο για να βελτιώνετε συνεχώς την οικονομική σας σταθερότητα και ασφάλεια. Ας ρίξουμε μια ματιά σε 4 πρακτικά βήματα που μπορείτε να κάνετε αμέσως για να κάνετε τα χρήματά σας να δουλεύουν για εσάς.

1. Δημιουργήστε έναν προϋπολογισμό και τηρήστε τον

Ο προϋπολογισμός είναι ένα κρίσιμο εργαλείο για να αλλάξετε την προσέγγισή σας στη διαχείριση των χρημάτων. Πριν μπορέσετε να αποταμιεύσετε και να επενδύσετε, τα μηνιαία σας έσοδα πρέπει να υπερβαίνουν τα μηνιαία σας έξοδα. Δημιουργώντας έναν προϋπολογισμό, αποκτάτε επίγνωση των πηγών του εισοδήματός σας και κατανέμετε τα χρήματά σας στοχευμένα, επιτρέποντάς σας να ευθυγραμμίζετε τα χρήματά σας με τους στόχους σας αντί να ξοδεύετε χωρίς σχέδιο. Ένας προϋπολογισμός σας επιτρέπει:

- να παρακολουθείτε πού πηγαίνουν τα χρήματά σας

- Εντοπίστε τις κακές οικονομικές συνήθειες

- Αποπληρώστε χρέη

- Προτεραιοποιήστε τις δαπάνες για πράγματα που είναι σημαντικά για εσάς

- Αποθηκεύστε για το μέλλον

Ο προϋπολογισμός είναι μια συνεχής διαδικασία που απαιτεί ενεργό συμμετοχή. Μπορεί να απαιτεί προσαρμογές από μήνα σε μήνα για να ληφθούν υπόψη σημαντικά έξοδα ή αλλαγές στις καταναλωτικές συνήθειες. Όταν έχετε μια σαφή κατανόηση του εισοδήματός σας, η λήψη συνειδητών αποφάσεων για τις δαπάνες σας δίνει τη δυνατότητα να αναλάβετε τον έλεγχο των οικονομικών σας και δημιουργεί τις προϋποθέσεις για να κάνετε τα χρήματά σας να λειτουργούν με τον τρόπο που εσείς θέλετε, αντί να αισθάνεστε ότι περιορίζεστε από τις οικονομικές συνθήκες.

2. Αποπληρώστε τα χρέη σας και αποφύγετε νέα

Το να έχετε χρέη σημαίνει ότι πληρώνετε περισσότερα από το αρχικό κόστος αγοράς, καθώς οι πληρωμές τόκων μπορούν να μειώσουν σημαντικά το εισόδημά σας. Τα χρέη δυσκολεύουν τα χρήματά σας να δουλέψουν για εσάς, επειδή ένα μέρος τους πηγαίνει σε πληρωμές τόκων. Δημιουργεί οικονομικά βάρη και περιορίζει τις επιλογές σας. Από την άλλη πλευρά, η αποπληρωμή του χρέους σας επιτρέπει να ανακατευθύνετε αυτά τα χρήματα προς ό,τι έχει σημασία για εσάς, όπως άλλοι οικονομικοί στόχοι (π.χ. αποταμίευση για την εκπαίδευση, τη συνταξιοδότηση, τα ταξίδια ή τη βελτίωση των συνθηκών διαβίωσής σας), την έναρξη μιας επιχείρησης ή την επένδυση. Αν νιώθετε ότι σας έχει καταβάλει ένα σημαντικό ποσό χρέους, μπορείτε να χρησιμοποιήσετε τη μέθοδο της χιονοστιβάδας:

- Καταβάλλετε μόνο την ελάχιστη πληρωμή για όλα τα χρέη εκτός από το μικρότερο.

- Χρησιμοποιήστε τυχόν επιπλέον χρήματα για να αποπληρώσετε το μικρότερο χρέος.

- Μόλις εξοφλήσετε το μικρότερο χρέος, προχωρήστε στο αμέσως μικρότερο.

Όσο εξοφλείτε τα μικρότερα χρέη σας, περισσότερα χρήματα θα είναι διαθέσιμα για να αντιμετωπίσετε τα μεγαλύτερα.

3. Δημιουργήστε ένα ταμείο έκτακτης ανάγκης

Ένας τρόπος για να αποφύγετε την ανάληψη νέων χρεών είναι να έχετε ένα ταμείο έκτακτης ανάγκης όπου μπορείτε να βάζετε χρήματα για να καλύψετε απρόβλεπτα έξοδα. Εάν προκύψει μια έκτακτη ανάγκη, μπορείτε να βάλετε τα χρήματα στο ταμείο σας για να εργαστείτε και να ανακτήσετε τον έλεγχο της κατάστασης. Η δημιουργία ενός ταμείου έκτακτης ανάγκης απαιτεί χρόνο και, ιδανικά, θα πρέπει να ισοδυναμεί με το εισόδημα τριών έως έξι μηνών'? Ωστόσο, κάθε μικρό ποσό που μπορείτε να βάλετε στην άκρη θα βοηθήσει. Εάν εξακολουθείτε να αποπληρώνετε χρέη ή έχετε περιορισμένη ευελιξία στον προϋπολογισμό σας, βάλτε στην άκρη ό,τι μπορείτε σε μια κατηγορία "ξαφνικών εξόδων" και μεταφέρετε τα συσσωρευμένα κεφάλαια σε έναν ξεχωριστό αποταμιευτικό λογαριασμό στο τέλος κάθε μήνα.

4. Αποθηκεύστε και επενδύστε τα χρήματά σας

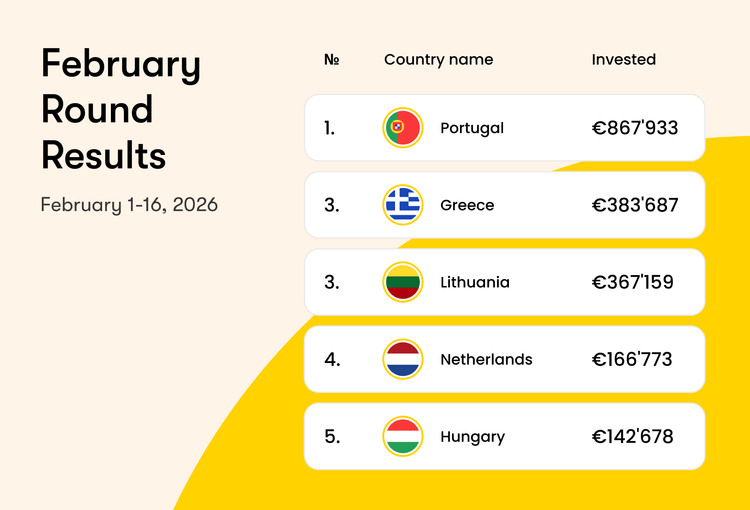

Αφού'έχετε απελευθερώσει επιπλέον χρήματα πληρώνοντας τα χρέη σας, μπορείτε να κάνετε τα χρήματά σας να δουλέψουν για εσάς αποταμιεύοντας και επενδύοντας. Οι συγκεκριμένοι αποταμιευτικοί και επενδυτικοί σας στόχοι θα εξαρτηθούν από παράγοντες όπως η ηλικία, ο τρόπος ζωής και οι φιλοδοξίες σας. Να θυμάστε, όταν πληρώνετε τόκους, χάνετε χρήματα. Αντίθετα, όταν κερδίζετε τόκους, τα χρήματά σας δημιουργούν από μόνα τους πρόσθετο εισόδημα. Εάν δεν χρειάζεστε τις αποταμιεύσεις σας για αρκετά χρόνια ή δεκαετίες, ένας από τους πιο αποτελεσματικούς τρόπους για να κάνετε τα χρήματά σας να δουλέψουν για εσάς είναι να τα επενδύσετε. Οι επενδύσεις επιτρέπουν στα χρήματά σας να αυξάνονται μέσω των τόκων, της εκτίμησης και των πιθανών πληρωμών μερισμάτων. Μπορείτε να επιλέξετε είτε να χρησιμοποιήσετε τα μερίσματα ως συμπληρωματικό εισόδημα είτε να τα επανεπενδύσετε για να αυξήσετε το επενδυτικό σας χαρτοφυλάκιο. Ανεξάρτητα από τον τρόπο με τον οποίο αποταμιεύετε ή επενδύετε, θα πρέπει να έχετε ένα συγκεκριμένο σύνολο στόχων. Η ύπαρξη ξεκάθαρων στόχων θα σας βοηθήσει να εστιάσετε τις δαπάνες σας, θα σας δώσει κίνητρα και θα καθοδηγήσει την επιλογή των κατάλληλων τύπων επενδύσεων.

Τελευταίες αναρτήσεις