Voldoen aan de behoeften van investeerders: Een secundaire markt voor leningen introduceren

We zijn verheugd om een belangrijke verbetering van ons platform aan te kondigen die jouw investeringservaring enorm kan verbeteren - de introductie van een secundaire markt voor leningen door de toewijzing van leningen tussen investeerders. Dit proces wordt in strategische stappen geïmplementeerd om maximaal voordeel te bieden aan onze gevarieerde gemeenschap van investeerders.

Sommige van onze beleggers vinden het prettig om hun geld binnen de standaardtermijn van 6 maanden te ontvangen, terwijl anderen de voorkeur geven aan 12 maanden. Er zijn echter ook mensen die onmiddellijk toegang tot hun geld willen. Met het oog op deze unieke behoeften zijn we de secundaire markt voor leningen geleidelijk aan het introduceren.

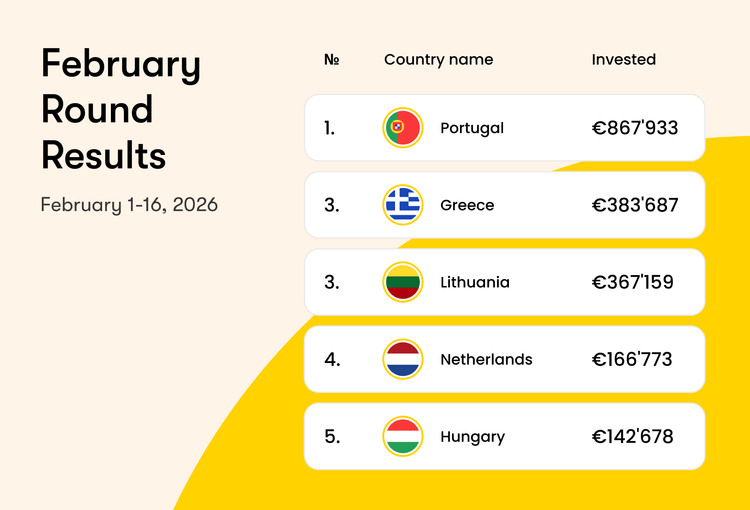

In ons huidige model worden leningen geïnvesteerd en terugbetaald binnen een periode van 6 maanden, zonder andere opties. In de eerste fase van de lancering van onze secundaire markt zullen we leningen die bijna aflopen en waarvoor in aanmerking komende merken 6 maanden extra willen, aanbieden aan nieuwe investeerders als onderdeel van een batch.

Rusted assured that this transition will be managed by Scramble and will not affect your initial repayment schedule. Als merken de aflossingsperiode willen verlengen, zullen we de bestaande leningen van onze investeerders aan potentiële nieuwe kopers voorleggen. Hierdoor zullen de oorspronkelijke investeerders nog steeds hun fondsen ontvangen binnen de initiële periode van 6 maanden zoals gepland. Aan de andere kant zullen de nieuwe investeerders die de lening overnemen beginnen met het ontvangen van fondsen in de daaropvolgende periode van 6 maanden, alsof het een nieuwe lening aan het merk is. Het doel van deze stap is om de voorspelbaarheid van je rendement op investering over 6 maanden te vergroten, zelfs in het geval van verlengingen van leningen door de merken.

Onze toewijding aan flexibiliteit en beleggerstevredenheid houdt hier niet op. Binnenkort zullen we investeerders de mogelijkheid bieden om hun leningen zelf te koop aan te bieden, zodat ze hun fondsen nog sneller kunnen ontvangen dan de oorspronkelijke periode van 6 maanden. Deze functie zal een groot voordeel blijken te zijn voor degenen die snel over hun kapitaal moeten kunnen beschikken.

Kortom, de introductie van een secundaire markt voor leningen op ons platform is een belangrijke stap voorwaarts die ons zal helpen tegemoet te komen aan de dynamische behoeften van onze klanten en hen meer liquiditeit en flexibiliteit zal bieden.

Veel gestelde vragen

Hoe beïnvloedt de toewijzing van de lening mijn huidige leningen?

De toewijzing van de lening vergroot de kans op tijdige aflossing binnen de eerste 6 maanden.

Kan ik investeren in leningen van andere investeerders'? Ja, dat kan. Deze leningen komen beschikbaar in de volgende ronde.

Wat gebeurt er als ik geen toestemming geef voor de toewijzing van de lening?

Als je geen toestemming geeft voor de toewijzing van de lening, wordt je geld gewoon terugbetaald en ben je uitsluitend afhankelijk van het geld van de merken. Houd er rekening mee dat de merken het recht hebben om betalingen uit te stellen en de leenperiode met 6, 12 of 18 maanden te verlengen, waardoor het terugbetalingsschema kan veranderen of worden verlengd.

Wat gebeurt er als een merk de leentermijn verlengt?

Als je toestemming geeft voor de overdracht van de lening, heeft dit geen invloed op je oorspronkelijke aflossingsschema. Zo niet, dan wordt je aflossingsschema verlengd.

Zijn mijn huidige leningen niet langer beschermd?

Leningtoewijzing heeft geen invloed op je leningbescherming. Afhankelijk van de leninggroep die je kiest, heb je nog steeds drie niveaus van bescherming.

Zien andere investeerders mijn persoonlijke gegevens?

Nee, dat zullen ze niet. In het geval van toewijzing van een lening zien andere investeerders alleen je Scramble ID, zonder toegang tot persoonlijke informatie.