Veelgestelde vragen van beleggers: Antwoorden en inzichten

Met ingang van april 2024 hebben we een aantal belangrijke wijzigingen doorgevoerd in onze leenstrategieën om zowel onze beleggersgemeenschap als de bedrijven die we ondersteunen beter van dienst te zijn. Deze veranderingen hebben geleid tot verschillende vragen van beleggers en we zijn hier om duidelijkheid te verschaffen over de meest gestelde vragen.

Vraag 1. Waarom is het aflossingsschema onder de Financieringsovereenkomsten gewijzigd?

Voorheen werkten we met een enkele terugbetalingsstructuur onder de Financieringsovereenkomst. Maar om bedrijven meer aangepaste oplossingen te bieden en het rendement voor investeerders te optimaliseren, bieden we nu twee verschillende plannen: het Standaardplan en het Geavanceerde plan. Laten we eens kijken naar de details van elk plan en hoe deze van invloed zijn op de terugbetalingsschema's.

Het Standaard Plan is ontworpen om de cashflow te optimaliseren, waardoor het ideaal is voor beginnende merken met een volatiele of sterk seizoensgebonden verkoop. Het heeft een rentevoet onder de Financieringsovereenkomst van 9% per zes maanden, met een maandelijkse aflossing van 2% en een effectieve jaarlijkse kapitaalkost van 20%.

Het Advanced Plan, aan de andere kant, is ontworpen om de kosten van kapitaal te optimaliseren en is geschikt voor grotere merken met een gestage, voorspelbare cashflow. Het biedt een verlaagde rente onder de Financieringsovereenkomst van 6% per zes maanden, met een hogere maandelijkse betaling van 8% en een effectieve jaarlijkse kapitaalkost van 16%.

De variatie in aflossingsschema's vloeit voort uit deze verschillende plannen, die elk zijn afgestemd op de unieke behoeften van bedrijven in verschillende stadia van ontwikkeling.

Vraag 2. Wat moet ik doen om 1% rendement te behalen?

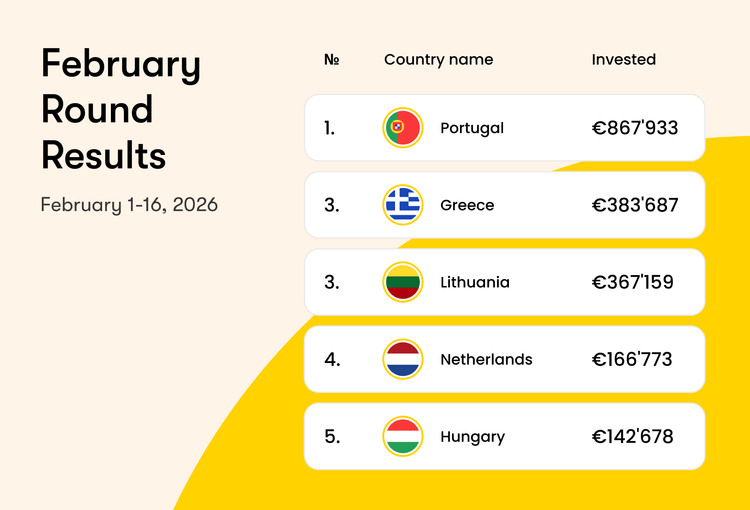

Om in aanmerking te komen voor het rendement van 1%, moeten investeerders hun account financieren met ten minste €100 tussen het einde van de vorige ronde en het einde van de huidige ronde. Om dit voordeel te ontvangen, moet je ook ten minste €100 investeren binnen de huidige ronde, meestal van de 1e tot de 16e van de maand. Houd er rekening mee dat de verwerking van bankoverschrijvingen 1–3 werkdagen in beslag kan nemen.

Vraag 3. Wat is de reden om de terugbetaling aan het einde van de looptijd te plannen in plaats van aan het begin?

Terugbetaling aan het einde van de looptijd is in overeenstemming met ons renteberekeningsmodel, dat een maandelijkse rente opbouwt van 0,75%–1% van de uitstaande hoofdsom onder de Financieringsovereenkomsten. Dit zorgt ervoor dat beleggers een nauwkeurig rendement ontvangen op basis van de uitstaande hoofdsom en de opgebouwde rente over de beleggingsperiode. Eventuele wijzigingen in het aflossingsschema, zoals verlengingen of uitstel door de merken, kunnen van invloed zijn op de rendementsberekening, vandaar de beslissing om de aflossingen aan het einde van de looptijd af te ronden.

Vraag 4. In welke groep moet ik €100 investeren? A of B?

Beleggers hebben de flexibiliteit om te kiezen tussen groep A en groep B op basis van hun voorkeur voor de voorwaarden binnen elke groep. Daarnaast is het toegestaan om in beide groepen tegelijk te beleggen, zodat beleggers hun portefeuille kunnen diversifiëren en de rendementskansen kunnen maximaliseren. Als een belegger bijvoorbeeld €40 belegt in Groep B en nog eens €60 in Groep A, dan wordt geacht te zijn voldaan aan de rendementseis van 1%.

Vraag 5. Waarom zijn er geen terugbetalingen direct na afloop van de ronde?

Volgens onze bijgewerkte voorwaarden vindt de eerste terugbetaling van de hoofdsom onder de financieringsovereenkomsten plaats op de 5e van de maand volgend op de investeringsperiode. Dit zorgt voor een gestroomlijnd proces voor het beheer van terugbetalingen en is in lijn met ons streven naar transparantie en verantwoording.

We hopen dat deze antwoorden duidelijkheid en geruststelling bieden aan onze gewaardeerde investeerders. Mocht u nog vragen hebben of hulp nodig hebben, aarzel dan niet om contact op te nemen met ons toegewijde Support Team. Hartelijk dank voor uw blijvende vertrouwen en partnerschap!

Laatste berichten