Εισαγωγή ενισχυμένων όρων για την ομάδα Α

Είμαστε ενθουσιασμένοι που εισάγουμε νέους όρους για τους επενδυτές της ομάδας Α! Με βάση τα σχόλια των επενδυτών μας, βλέπουμε ότι διαφορετικοί πελάτες χρησιμοποιούν το Scramble για διαφορετικούς σκοπούς. Ορισμένοι επενδυτές στοχεύουν στη μεγιστοποίηση των κερδών τους, ενώ άλλοι επιδιώκουν την ευελιξία για να βγάλουν κεφάλαια το συντομότερο δυνατό. Παρόμοια διαφορά συμβαίνει και από την πλευρά των εμπορικών σημάτων που δανείζονται κεφάλαια: ορισμένοι θέλουν να ελαχιστοποιήσουν τις τακτικές μηνιαίες πληρωμές τους και να αποπληρώσουν όσο το δυνατόν μεγαλύτερο μέρος του δανείου στο τέλος, ενώ άλλοι θέλουν να ελαχιστοποιήσουν το πραγματικό κόστος των κεφαλαίων και είναι ευχαριστημένοι να κάνουν μεγαλύτερες αποπληρωμές κάθε μήνα. Εισάγουμε αλλαγές στους όρους για τους επενδυτές της ομάδας Α για να είμαστε σε θέση να εξυπηρετήσουμε καλύτερα κάθε ομάδα πελατών μας.

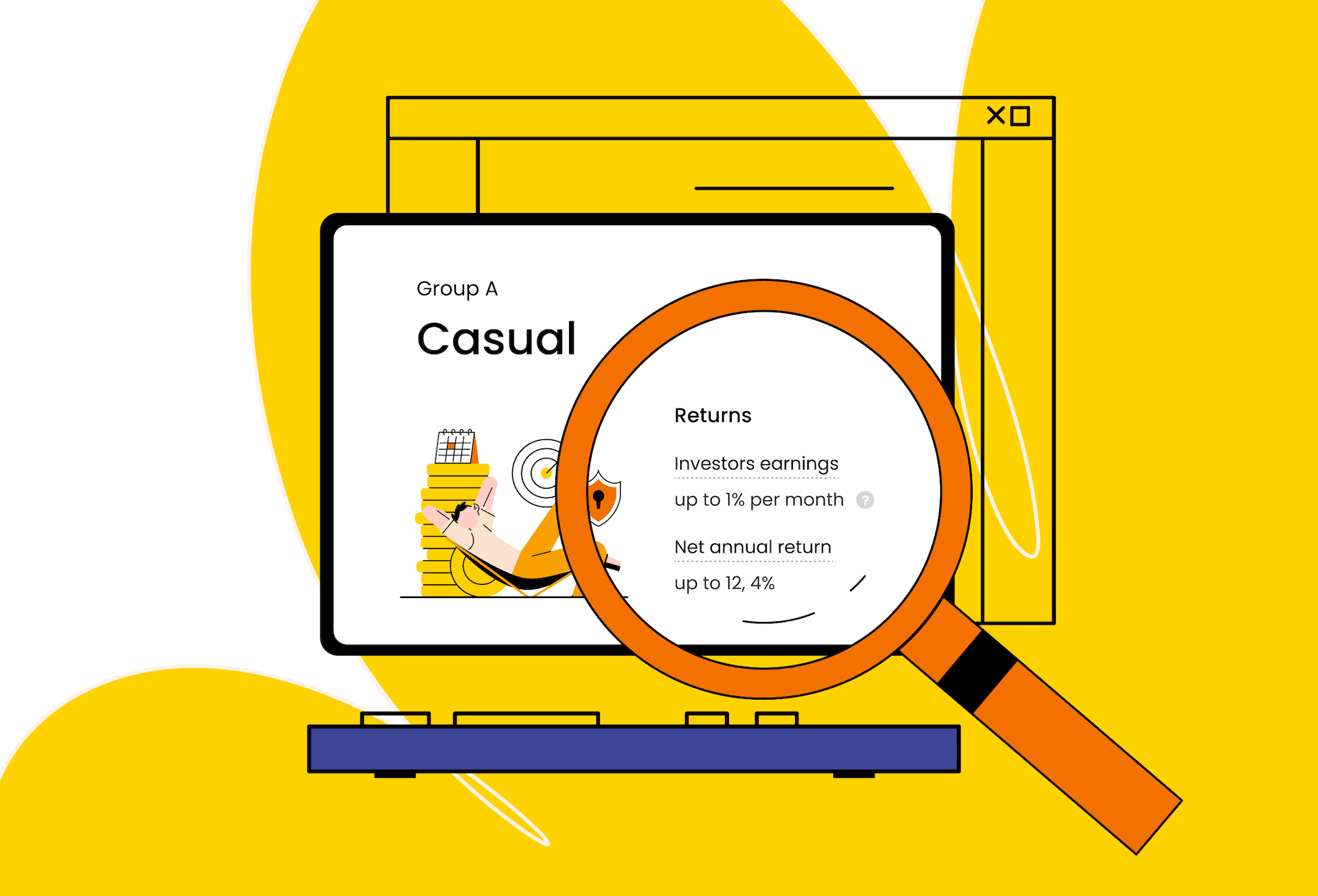

Τι νέο υπάρχει για τους επενδυτές της ομάδας Α;

Οι επενδυτές της ομάδας Α θα δουν τώρα γρηγορότερη επιστροφή κεφαλαίου και ένα μεγαλύτερο μερίδιο να επιστρέφεται κατά τους μήνες 1–5. Οι τακτικοί χρήστες μπορούν επίσης να πληρούν τις προϋποθέσεις για υψηλότερο μηνιαίο εισόδημα. Εδώ’είναι τι άλλαξε.

Στόχος ετήσιας απόδοσης έως 12,4%

Με την Ομάδα Α (Senior Claims), οι επενδυτές μπορούν να στοχεύσουν σε πραγματική ετήσια απόδοση έως και 12,4%, διαθέσιμη σε πελάτες που πληρούν τον μηνιαίο κανόνα του 1% (λεπτομέρειες παρακάτω).

Κέρδη με βάση εκτεθειμένο κεφάλαιο

Το εισόδημα για την ομάδα Α υπολογίζεται ανά μήνα επί του εκκρεμούς κεφαλαίου βάσει των υποκείμενων συμβάσεων χρηματοδότησης:

-

0,75%/μήνα βασικό επιτόκιο.

-

1%/μήνα αν πληροίτε τις προϋποθέσεις του κανόνα “τακτική επένδυση”.

Παράδειγμα: Εάν κατέχετε €1.000 στην ομάδα Α Απαιτήσεις τον Απρίλιο, συγκεντρώνετε €7.50 με 0,75% ή €10,00 με 1% για τον Απρίλιο. Το εισόδημα συσσωρεύεται κάθε μήνα και καταβάλλεται στο τέλος της 6μηνης διάρκειας μαζί με το τελικό τμήμα του κεφαλαίου.

Επιβραβεύσεις για τακτική επένδυση (ο 1%/μήνα κανόνας)

Για να λάβετε 1% (αντί για 0,75%) για έναν δεδομένο μήνα, κάντε κάποιο από τα ακόλουθα τον ίδιο μήνα:

-

Καταθέστε και επενδύστε τουλάχιστον €100, ή

-

Διατηρείτε ένα ενεργό επενδυτικό υπόλοιπο ύψους €10.000 ή περισσότερο.

Ο κανόνας ισχύει πλέον μηνιαίως (όχι αναδρομικά για ολόκληρη την περίοδο). Εάν χάσετε το όριο σε έναν μήνα, εξακολουθείτε να παίρνετε 1% για τους μήνες που πληρούν τις προϋποθέσεις και 0,75% για τον μήνα που χάσατε.

Ο κανόνας των 10.000 υπολοίπων υπολογίζει το σύνολο του ενεργού υπολοίπου σας στις ομάδες Α και Β, αλλά το αυξημένο εισόδημα ισχύει μόνο για την ομάδα Α.

Πρόγραμμα αποπληρωμής (κεφάλαιο)

Οι επιστροφές κεφαλαίου βάσει των συμφωνιών χρηματοδότησης οδηγούν σε διανομές σε εσάς:

-

Αναμένετε περίπου 30–50% του κεφαλαίου πίσω κατά τους μήνες 1–5 (batch-dependent).

-

Το υπολειπόμενο κεφάλαιο επιστρέφεται τον μήνα 6, όταν καταβάλλονται και τα δεδουλευμένα έσοδα.

Προηγουμένως, έως και ~80% μπορούσε να φτάσει μόνο τον 6ο μήνα- τώρα το κεφάλαιο επιστρέφει γρηγορότερα, βελτιώνοντας τη ρευστότητα.

Οφέλη από τους νέους όρους

-

Υψηλότερο πραγματικό ετήσιο επιτόκιο. Κερδίζετε έως και 12,4% διατηρώντας την προστασία και την ευκολία των Απαιτήσεων Ομάδας Α.

-

Ταχύτερη επιστροφή κεφαλαίου. Περισσότερο κεφάλαιο φτάνει νωρίτερα (μήνες 1–5), ώστε να μπορείτε επανεπενδύσετε ή να αποσύρετε νωρίτερα.

-

Μικρότερη έκθεση με την πάροδο του χρόνου. Η ταχύτερη επιστροφή κεφαλαίου μειώνει τόσο τον επιχειρηματικό κίνδυνο όσο και τον κίνδυνο “εναλλακτικής χρήσης” να κρατάτε το κεφάλαιο κλειδωμένο όταν εμφανίζονται άλλες ευκαιρίες.

Συμπερασματικά

Αυτές οι βελτιώσεις δίνουν στους επενδυτές της ομάδας Α περισσότερη ευελιξία, διαφάνεια και δυνητική απόδοση—είτε ξεκινάτε με €10 είτε διαχειρίζεστε €30.000. Ελέγξτε τους όρους και δείτε πώς ο κανόνας του 1% ανά μήνα και το ταχύτερο χρονοδιάγραμμα κεφαλαίου μπορεί να ταιριάζει στο σχέδιό σας.

FAQ

Πώς μπορώ να πάρω το μηνιαίο ποσοστό 1% για την ομάδα Α;

Για κάθε μήνα, που θέλετε 1%, είτε επενδύστε τουλάχιστον €100 από τον λογαριασμό σας στο Scramble εκείνου του μήνα είτε διατηρήστε ένα ενεργό υπόλοιπο ≥ €10.000. Διαφορετικά, ο συγκεκριμένος μήνας συσσωρεύεται με 0,75%.

Πώς καταβάλλεται η απόδοση της ομάδας Α;

Το εισόδημα συσσωρεύεται μηνιαίως επί του ανεξόφλητου κεφαλαίου (0,75% ή 1% ανάλογα με την επιλεξιμότητα του μήνα’και καταβάλλεται στο τέλος της 6μηνης διάρκειας, μαζί με το τελικό τμήμα του κεφαλαίου. Το ίδιο το κεφάλαιο διανέμεται μηνιαίως, με περίπου 30–50% να εξοφλείται κατά τη διάρκεια των μηνών 1–5 και το υπόλοιπο τον μήνα 6.

Πώς επιτυγχάνω την πραγματική ετήσια απόδοση του 12,4%;

Διεκδικήστε το 1% στους περισσότερους μήνες (χρησιμοποιώντας τον παραπάνω μηνιαίο κανόνα) και επανεπενδύστε με συνέπεια για να κάνετε ανατοκισμό σε όλους τους γύρους.

Τελευταίες αναρτήσεις