Einführung unseres neuen Geschäftsmodells für die Darlehensvergabe

Nach sorgfältiger Planung und harter Arbeit freuen wir uns, eine Reihe von Verbesserungen einführen zu können, die Ihr Vertrauen in unsere Plattform stärken. In diesem Artikel führen wir Sie durch die Mechanismen dieses neuen Ansatzes und zeigen Ihnen, wie er die Sicherheit Ihrer Investitionen erhöht.

Seit über einem Jahr arbeitet Scramble aktiv mit Lebensmittel- und Getränkemarken auf dem dynamischen britischen Markt zusammen. Diese Entscheidung wurde bewusst getroffen, da der Markt inmitten geopolitischer Veränderungen sehr widerstandsfähig ist. Unser Standort in der EU war jedoch mit rechtlichen Beschränkungen verbunden, was zur Einführung eines klassischen Crowdfunding-Modells führte. Bei diesem Modell erleichterte Scramble die Markenauswahl und den Geldfluss, wobei die Verträge direkt zwischen Investoren und Marken geschlossen wurden. Unser neues, verbessertes Modell bietet eine bessere Integration in den Schutz und die Vorschriften für inländische Kreditverträge in Großbritannien. Gleichzeitig erfüllt es die für Kleinanleger geltenden EU- und estnischen Vorschriften in vollem Umfang. Für ein gründliches Verständnis der Gründe für diese Umstellung verweisen wir auf unsere ausführliche Erklärung in der vorheriger Artikel.

Schematischer Überblick über ein neues Geschäftsmodell

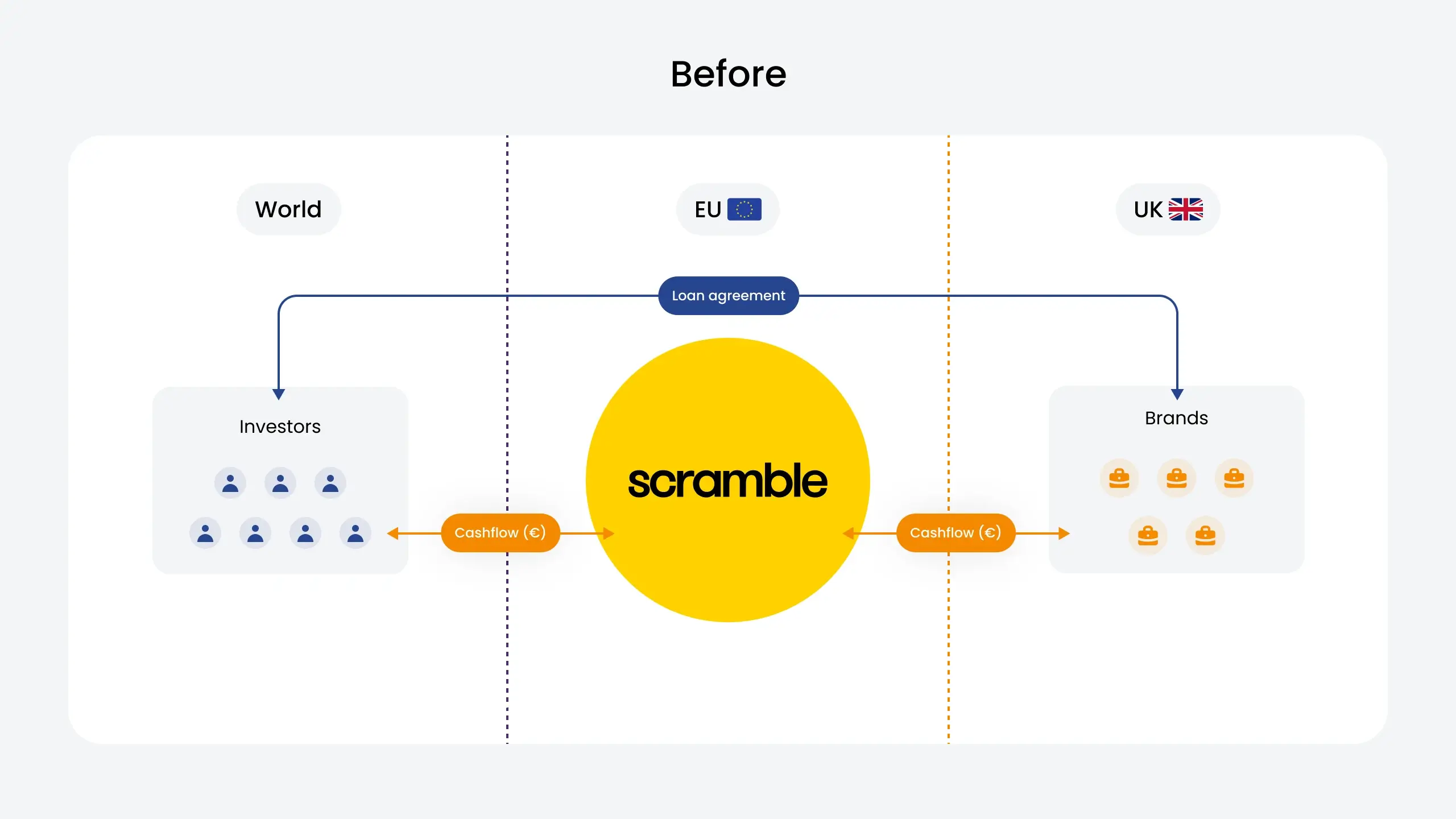

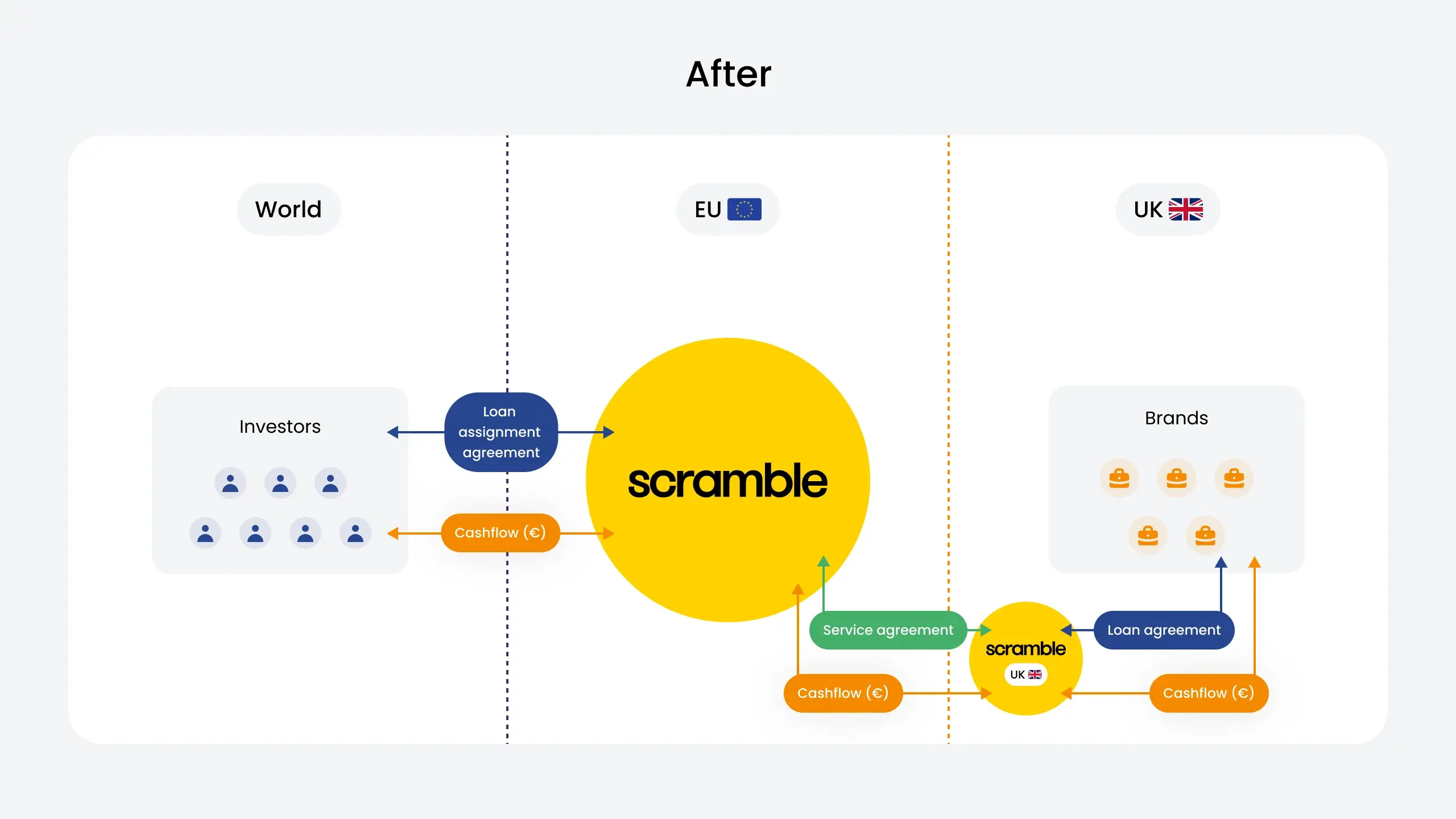

Um Transparenz und Klarheit über die Veränderungen zu schaffen, haben wir eine visuelle Darstellung vorbereitet, die unser bisheriges Geschäftsmodell mit dem neuen vergleicht. Zwei Bilder werden die Entwicklung unserer Bedingungen veranschaulichen und die Verbesserungen zugunsten des Anlegerschutzes hervorheben.

Sсheme 1: Investitionen sind naturgemäß mit Risiken verbunden, und trotz sorgfältiger Markenauswahl konnte die Unvorhersehbarkeit der Märkte die Marken vor finanzielle Herausforderungen stellen. Rechtliche Beschränkungen in verschiedenen Rechtsordnungen machten die Sache noch komplizierter.

Scheme 2: Um diesen Herausforderungen zu begegnen, haben wir ein neues Modell der Kreditvergabe eingeführt, indem wir Scramble UK, eine Kreditvergabeorganisation, gegründet haben. Im Rahmen dieses Modells vergibt Scramble UK direkt Kredite an Unternehmen im Geltungsbereich der Marken.

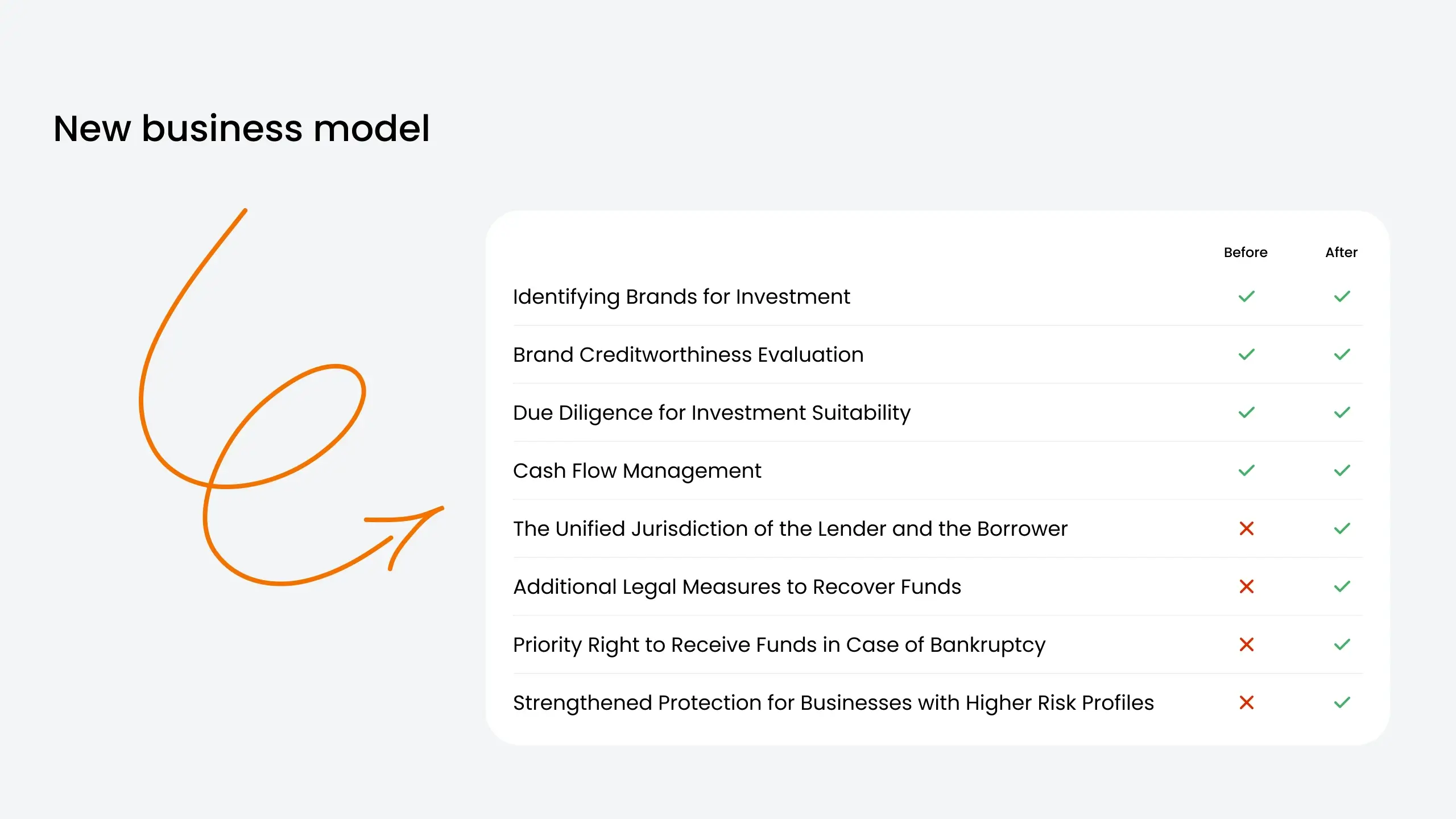

Damit wird der Horizont für rechtliche Interaktionen mit den Marken deutlich erweitert. Gleichzeitig bleibt Scramble aktiv an der Auswahl und Bewertung von Marken und Gütesiegeln beteiligt, um die Kontinuität unseres Engagements zu gewährleisten. Ein Vergleich zwischen den beiden Systemen zeigt, dass die Anleger nun einen besseren Schutz für ihre Gelder genießen, nämlich:

Scramble hat sich zu ständigen Verbesserungen verpflichtet, um die Sicherheit der Gelder unserer Investoren zu erhöhen. Wir haben das neue Geschäftsmodell zügig umgesetzt, wobei die nächste Runde unter dieser aktualisierten Struktur ab dem 5. Januar 2024 geplant ist. Die kürzliche Einführung unseres neuen Darlehensvergabemodells wird Ihre Anlegererfahrung nicht beeinträchtigen. Wir haben die Konsistenz der finanziellen Bedingungen, der Lose, der Schnittstelle und der monatlichen Rückzahlungen beibehalten. Die Änderungen beschränken sich auf die juristische Dokumentation, so dass ein reibungsloser Ablauf für unsere Anleger gewährleistet ist. Wir hoffen, dass sich diese Änderungen als nützlich erweisen werden, um die Gelder der Anleger im Laufe der Zeit besser zu schützen.

>Wir danken Ihnen, dass Sie uns auf unserem Weg zu einer sichereren Anlageerfahrung begleiten.

Neueste Beiträge