Navigating Tax Season

Embark on a journey to financial clarity with our latest feature announcement! In this guide, we explore your crucial role in tax compliance, providing essential tips on understanding your responsibilities and the importance of consulting with your accountant. Plus, discover how our new feature on Scramble, allowing you to download tax reports in PDF format, makes managing your financial insights easier than ever.

In today's dynamic financial landscape, staying informed about your tax obligations is crucial. As a responsible investor, you play a pivotal role in ensuring compliance with tax regulations. Here's a comprehensive guide to help you navigate the intricate web of tax responsibilities, with an essential reminder that it is your sole responsibility to adhere to the legislation and regulations of your country.

Understanding Your Responsibility

It is your sole responsibility to pay taxes in accordance with the legislation and regulations of your country. Whether you're an individual or a company, compliance with income tax, VAT, and other tax regulations is paramount. By staying informed and proactive, you not only fulfil your legal obligations but also contribute to the overall financial integrity of your investments.

Consulting with Your Accountant

If you find yourself unsure about how to declare the earnings you receive, whether as an individual or a company, seeking guidance from a qualified accountant is essential. Your accountant is a valuable resource who can provide personalized advice tailored to your unique financial situation. Schedule a consultation to discuss your earnings, investments, and any potential tax liabilities you may need to address.

Utilizing Scramble for Financial Clarity

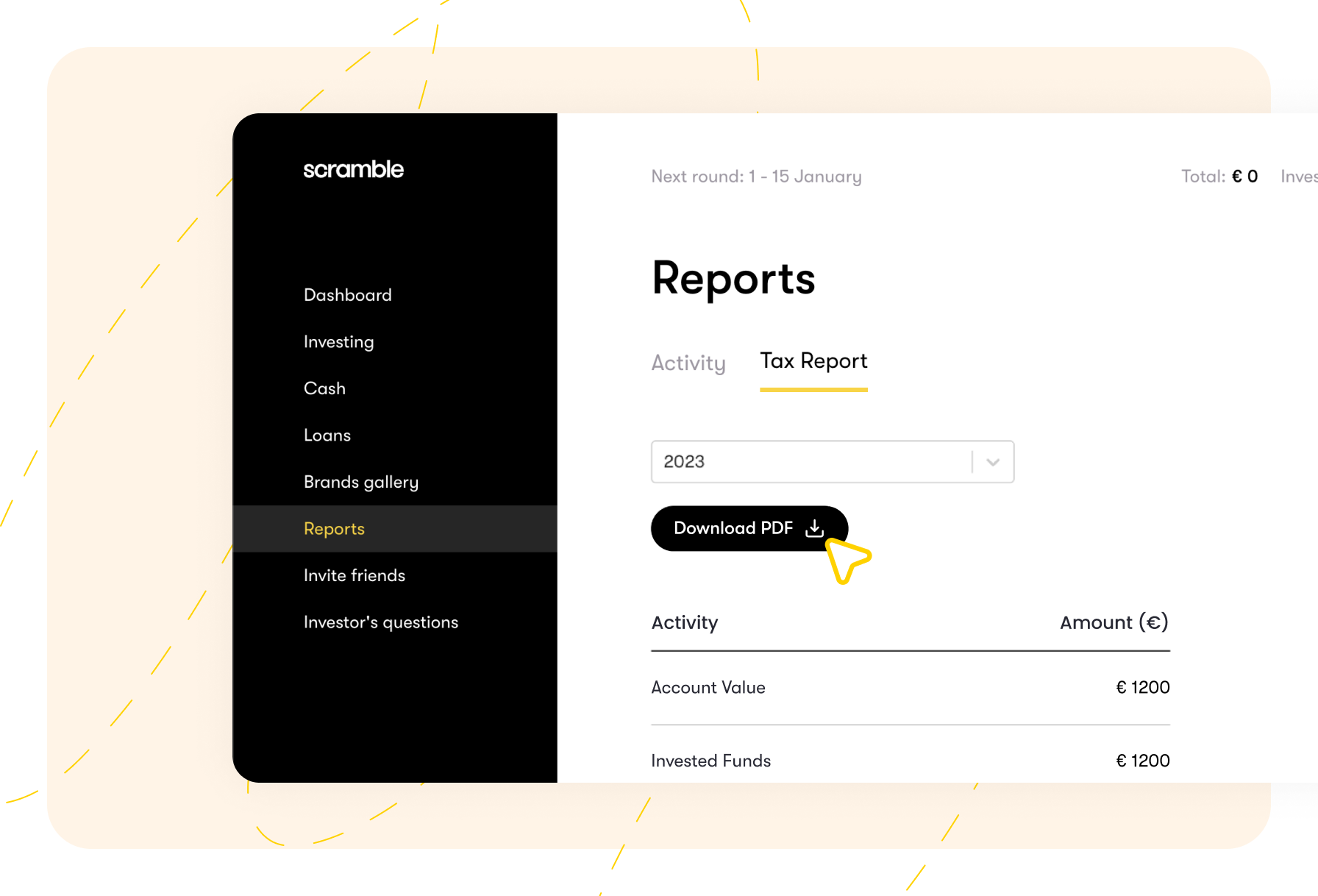

In tandem with your commitment to tax compliance, Scramble is here to make your financial journey smoother. We're thrilled to announce a new feature that allows you to effortlessly access and download your tax reports directly from your Scramble account. This feature, available in PDF format, provides you with a user-friendly and comprehensive overview of your financial insights.

Remember, while we strive to simplify your financial experience, it's important to stay informed about your tax obligations. Use Scramble as a tool to enhance your financial clarity, but always consult with your accountant for personalized advice and guidance.